Nearly 1.6 million homeowners are in the process of moving, marking an increase of 100,000 compared to last year, TwentyCi has revealed.

As part of the latest research for its Property & Homemover Report, the analytics firm revealed that the market is operating at an elevated level compared to this time last year. During 2025, over 1.4 million properties have been listed for sale, which is +3.7% higher than 2024. And there are now more than one million properties with a sale agreed this year, +5.1% higher than 2024.

Given these numbers, TwentyCi has forecast that property transactions will reach 1.15 million at the end of the year, +7% higher than the 1,102,400 purchases recorded in 2024.

This trend bodes well for homeware retailers, since homemovers represent a high-intent customer group, typically purchasing new furniture, appliances and essentials to suit their new environment. Many also undertake renovations or repairs and are more likely to review and switch providers across utilities, broadband, insurance and related services.

Colin Bradshaw, CEO of TwentyCi, says: “Our latest market analysis indicates an increase in property transactions YoY, a promising sign for retailers supporting homemovers as they personalise their new spaces. With an average spend of £1,500 per buyer across 1.15 million sales, that’s £1.73b in potential expenditure. Add renters to the equation, and the opportunity approaches £2.17b.”

Given that homemovers spend considerably more than non-movers, they constitute a valuable target demographic for retailers. Understanding the Homemover Wave, which is the series of predictable stages people go through when moving home and the consumer behaviours associated, is imperative, says TwentyCi: "In the first week alone, 7.7% of all mover purchases are made, and nearly a quarter (23.8%) of total spending lands within the first month. Yet the spending continues steadily, with the middle half of mover purchases occurring between day +8 and day +176 after a move.

"This timeline is grounded in observed consumer behaviour across multiple categories. Broadband installations typically happen before moving day, beds and sofas dominate the first 48 hours, flooring purchases follow once measurements are confirmed, and kitchen, bathroom and soft furnishing upgrades take place as rooms take shape. Even car sales show a notable spike around day +31.

"Together, these trends highlight the sustained and diverse economic impact of homemovers, a consumer group whose purchase activity fuels retail growth long after the boxes are unpacked."

Colin continues: “With around 100,000 more households moving home than at this time last year, there’s clear momentum in the market. Gaining insights into the Homemover Wave and identifying precisely when customers are most likely to purchase specific goods along their moving journey, enables retailers to optimise targeting and engage consumers at the most opportune moments.

“They should tap into the homemover opportunity by rolling out ‘move-in bundles’ during the first 30 days post-move, then shift focus to room upgrades, lighting, and outdoor spaces through months two and three. Homemovers deserve their own CRM journey because they shop differently, and their needs evolve fast.”

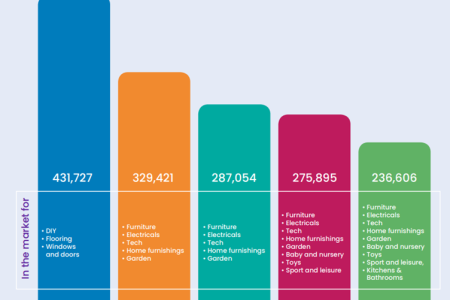

Here is an overview of the number of potential customers at each stage of the homemoving journey:

Download the full Property & Homemover Report here.